how to get amazon flex tax form

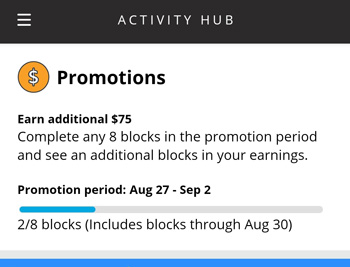

Then select Request call from support You should receive a call within 30 seconds. Increase Your Earnings.

Make sure that you have all the necessary information for enrollment.

. Please include the following information on your form so that we can locate your account. Supplier number vendor code publisher code etc. To obtain your Amazon Flex Debit Card account and routing numbers open your Amazon Flex Card app and tap on Direct Deposit.

There may be a delay in any refund due while the information is verified. Make sure that you have all the necessary information for enrollment. If you do not have an Amazon account create a new account with Amazon.

Schedule C is part of. Whatever drives you get closer to your goals with Amazon Flex. Amazon Flex Business Phone.

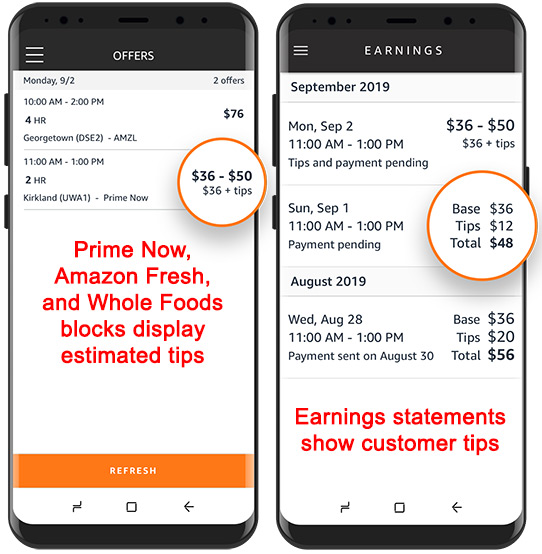

Adjust your work not your life. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

The Form 1099-K was mailed to the address you provided in the tax interview. 1099 NEC Tax Form When will I receive a 1099 form. Attach Form 4852 to the return estimating income and withholding taxes as accurately as possible.

If your payment is 600 or more you will receive a. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. Click the Download PDF link.

Go to the Amazon Flex App Menu Settings Personal Information Bank Account and insert your Amazon Flex Debit Card account and routing number. Go to the Tax Exemption Wizard. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after becoming aware of the FTCs investigation in 2019.

From the Reports section select Tax Document Library followed by the appropriate year and then Form 1099-K. Click Download to download copies of the desired forms. Entity type of your organization.

Follow the steps in the app and provide the information required by the app until all of the ticks are green. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by.

The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment. Once you have completed the form and signed with blue or black pen please mail to Amazon at. Gig Economy Masters Course.

Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. Amazon Flex Legal Business Name. If you have not received your Form W-2 by the due date and have completed steps 1 and 2 you may use Form 4852 Substitute for Form W-2 Wage and Tax Statement.

90 of the tax to be shown on. Go to the Tax Exemption Wizard. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties. Download the app and log on using your Amazon account. Territorystate in which you wish to enroll.

Exemption numbers or exemption form if applicable. Exemption numbers or exemption form if applicable. The Amazon Tax Exemption Wizard takes you through a self-guided process of enrollment.

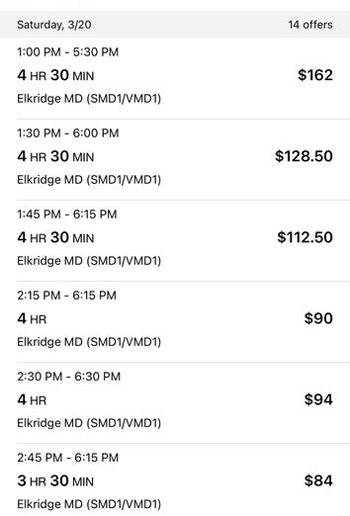

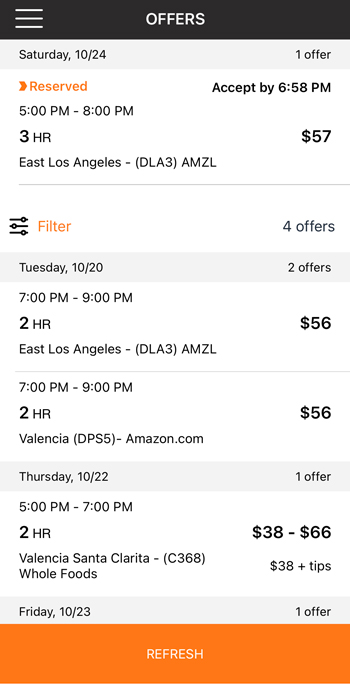

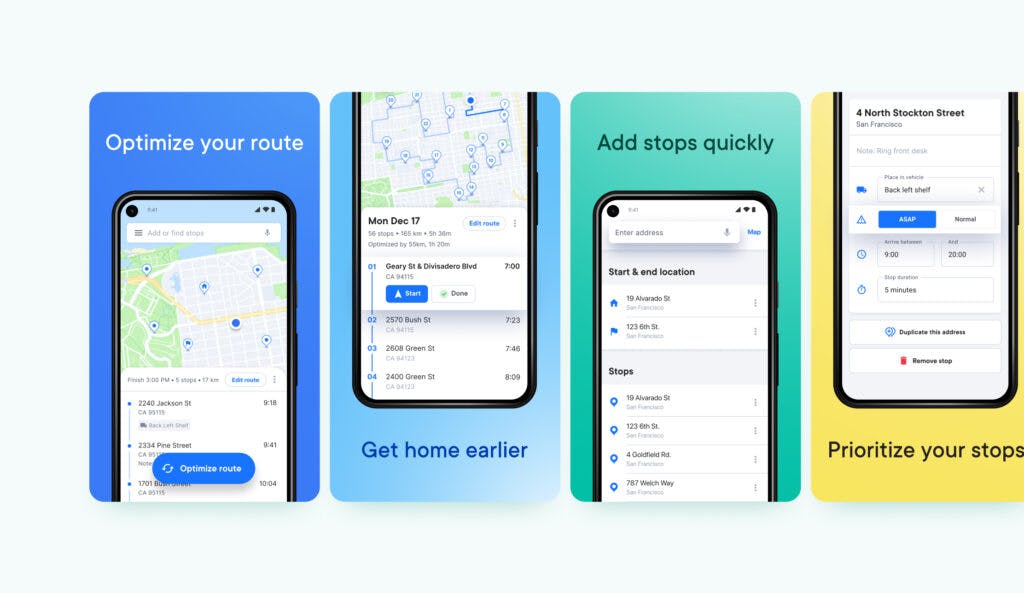

Box 80683 Seattle WA 98108-0683 USA. You can plan your week by reserving blocks in advance or picking them each day based on your availability. In the Amazon Flex app tap on the question mark in the top right corner to go to the Help page.

Choose the blocks that fit your schedule then get back. Territorystate in which you wish to enroll. 44 out of 5 stars.

Amazon Flex Business Address. Sign in using the email and password associated with your account. Use the app to request a call.

Click ViewEdit and then click Find Forms. We know how valuable your time is. Call Amazon directly.

410 Terry Avenue North Seattle WA 98109 What forms do you file with your tax return. You can reach support by calling 877 212-6150 or 888 281-6901. If you get a check please cash it before January 7 2022.

With Amazon Flex you work only when you want to. Amazon business for which you are supplying information. Blank 2021 W2 4 Up Tax Forms 100 Employee Sets Compatible with QuickBooks Online Ideal for E-Filing Works with Laser or Inkjet Printers 100 Sheets and 100 Self Seal Envelopes.

The main tax form you need to file is Schedule C. You expect your withholding and credits to be less than the smaller of. This is where you enter your delivery income and business deductions.

You can also retrieve the form from your seller account. Youll need to declare your Amazon flex taxes under the rules of HMRC self-assessment. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Entity type of your organization.

Tax Returns for Amazon Flex.

Official Condolence Letter How To Write An Official Condolence Letter Download This Official Condolence Letter Templ Condolence Letter Condolences Lettering

Bathroom Fan Auto Shut Off 1 2 4 8 Hour Preset Countdown Wall Switch Timer White 2 Amazon Com Bathroom Fan Timer Indicator Lights

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Crush Amazon Courier Delivery Top Driver Hacks

Amazon Introduces New Mental Health Benefit For All U S Employees And Their Family Members Business Wire

What It S Like To Be An Amazon Flex Delivery Driver Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Full Outfit Flex On Poison Ivy Halloween Costume Inspired By Uma Thurman S Portrayal In Batman Ro Poison Ivy Halloween Costume Halloween Costumes Poison Ivy

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To Crush Amazon Courier Delivery Top Driver Hacks

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

Digitek Drl 12c Professional 12 Inch Led Ring Light With Tripod Stand For Mobile Phones Camera 3 Color Mo Led Ring Light Led Ring Ring Light For Camera

Gst Registration Process In India How To Registered Under Gst In India Aadhar Card Financial Information Registration

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Mileage Tracking Explained Triplog

Tax Deductions For Uber Lyft And Amazon Flex Drivers How To File The Perfect Tax Return Youtube

How Much Would It Cost To Buy One Of Everything On Amazon Business News Things To Sell Stock Market